- #Past due payment how to#

- #Past due payment full#

- #Past due payment registration#

- #Past due payment plus#

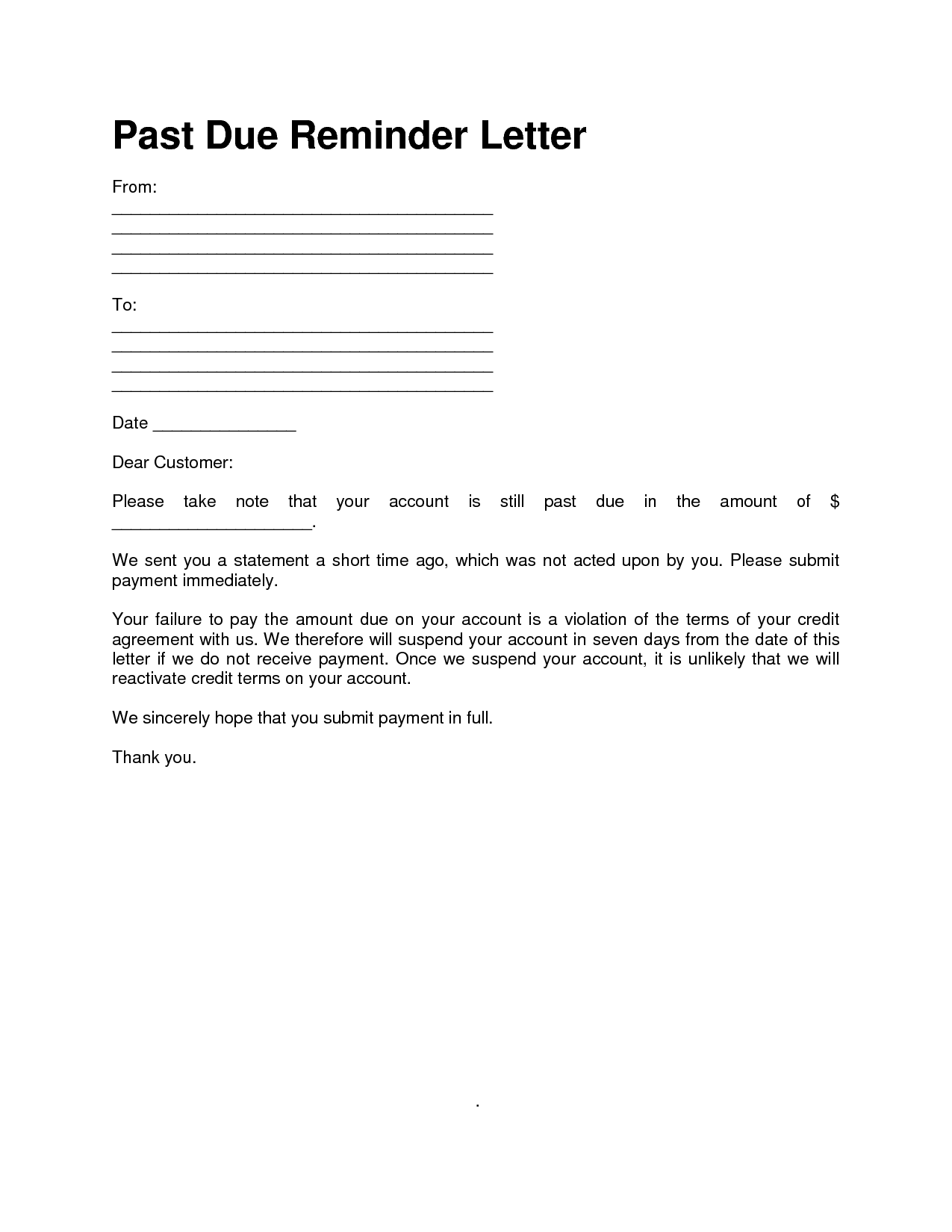

While you’re reading up on past due invoices, you may also encounter terms like “overdue invoices” or “unpaid invoices.” Don’t worry – these terms are all used to describe the same thing: invoices for which payment is outstanding. Past due invoices are – very simply – payments that haven’t been made by customers by the date agreed upon in the invoice’s payment terms. What is a past due invoice?įirst off, let’s define our terms.

#Past due payment how to#

Do you know how to follow up on a past due invoice? Learn a little more about the collections process you should follow with our helpful guide.

#Past due payment registration#

A transcript, diplomas, and registration hold will remain on the student account until the account is paid in full.Past due invoices can be a nightmare for your cash flow, but late payments are a problem that all businesses, big and small, end up dealing with on a regular basis. These accounts will also continue to be reported to the NC Department of Revenue for garnishment of tax refund money. These accounts will continue to be retained with a third-party collection agency and reported to the credit bureau.

#Past due payment plus#

However, the unpaid balance plus interest and late fees remains a legal obligation of the student.

#Past due payment full#

In addition, ECU will follow the State Employee Debt Collection Act (SEDCA) under North Carolina General Statute 143-553, which requires that employees whose salaries are paid in whole or in part by state funds must make full restitution of the amount owed to the state as a condition of employment or service.Notification is sent to individuals when funds are received from the NC Setoff Debt Collection ACT (SODCA) along with the procedure to request a hearing upon contestation. Upon review by the NC Attorney General’s Office, outstanding balances not paid after 90 days are forwarded to a North Carolina State approved collection agency as well as reported to the credit bureau and entered in the NC Department of Revenue database for garnishment of future tax refund money. If the outstanding balance is not paid within 60 days or satisfactory payment arrangements have not been established, the student will be referred to the NC Attorney General’s Office.While on a payment plan, a hold remains on the student account record, which will prevent obtaining transcripts, diplomas or registering for classes, until the balance has been paid in full. Upon receipt of the executed payment plan and the first installment, the collection process will be suspended but will resume if the student fails to make the monthly scheduled payments.Plans are based on the amount that is owed to the University. Please contact staff by email at or by phone at (252) 328-6816 for information on establishing a monthly payment plan. The collection process will continue until a payment plan has been executed and the first installment has been paid.A second letter is sent when the account balance is 60 days past due.

A hold will be placed on the student’s account, and all requests for readmission, transcripts or diplomas will be denied until the student’s account is paid in full. There are no exceptions to releasing holds with students who have an outstanding balance with the university.PAST DUE ACCOUNTS FOR NON-ENROLLED STUDENTS:Ī student’s account will be considered in past due status if the student is not currently enrolled at the University and the student’s account contains unpaid charges that have been outstanding 30 days or greater after the last day of the term.

0 kommentar(er)

0 kommentar(er)